Construction Loan Broker

Construction Home Loans

Construction home loans can be used to build a new house or make significant renovations and improvements to your existing house. This differs from a traditional home loan in that the valuation will be done based on what the house will be worth when it is finished rather than its current value. When you apply for a loan with a construction loan broker you will need a copy of the building contract, plans of the construction and details of fixtures and fittings for this assessment to be done.

It is ideal that all costs are included as part of a single fixed price building contract. If you have minor quotes such as carpets, pool or landscaping that you want to arrange yourself then you will have to pay these costs out of your own pocket if they are not part of the contract. This will increase the deposit you need. The reason that a construction mortgage lender will only pay costs that are part of a single contract is so that one builder is responsible for the entire project.

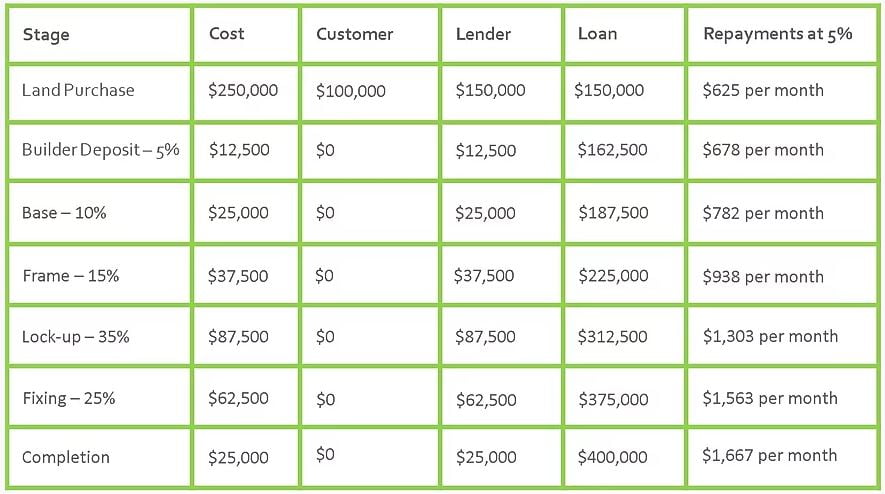

The payments to the builder will be done in stages after each stage of the construction is finished. The example below illustrates how a typical house construction loan may be paid in stages.

In the above example the customer has contributed $100,000 or a 20% deposit to avoid mortgage insurance. The deposit of the customer must be paid first and then the lender will pay the rest. At each stage the customer will get an invoice from the builder and will need to provide a written request to the bank to release the payment to the builder. This gives the customer control of the process so if there is any dispute with the builder as to the work done the bank will not release payment to the builder until the customer authorises this.

Lenders of construction loans will reserve the right to inspect the property at each stage to ensure the work is completed but it will depend on the lender and this may only happen at the start and completion of the project. Most lenders of construction loans will only charge interest during the construction period. This keeps payments to a minimum until the house is completed. You will see in the example above that the payments will slowly increase each month as the loan is paid to the builder in stages.

Further considerations of Construction Home Loans

Do not start construction until your house construction finance is approved

This may seem simple but it is amazing how many people fall into this trap. Even if you only need a small amount to finish the house most lenders will not provide any finance whatsoever on a partially completed house. It opens the construction finance lender to a range of legal issues if they have security of a partially completed house. Even if you will pay almost all of the cost yourself and just need a little bit to finish the property you must get your construction home loans approved before anything starts.

Government Grants for first home buyers can help but only when you start building

Currently the majority of First Home Buyer assistance is restricted to buying new property. If you chose to build a new property then you may qualify for a government grant (subject to other criteria of course). This grant is only paid once construction has started so often you will still require a deposit to buy the land but the grant can be paid once the building work starts so it can atleast go towards the building costs. If you are a First Home Buyer and are looking for construction home loans please contact Oak Tree finances – your local construction mortgage broker and we can discuss how this can work for you.

Speak to a construction loan broker if you plan to build a house yourself

If you are either a registered builder and would like to build your own house or you are looking to subcontract and project manage the building process please speak to us first. This is an area of lending that most lenders will not touch. We can find competitive solutions in a lot of situations but many of these avenues are not available if you start without arranging everything first. For construction loan lenders to even consider these requests they will want to be involved from the start so that they can ensure that the construction has been completed appropriately from the start. This area is outside the scope of this article but it is an area we know very well. Please call a construction mortgage broker from Oak Tree to discuss your unique situation.

Ready to get started? Call a construction loan broker specialist from OAK Tree Finances today on 0404 403 066 and we’ll find the perfect home building loans for you.

Ready to get the best in construction loans? Make an appointment with a construction loan broker or call us on 0404 403 066 to discuss your unique circumstances today.